It just keeps gettnig better and better, doesn't it? (Read: worse and worse).

I had heard all the data and statistics already so I knew this stuff was out but still, it's pretty sobering, what the media reported today.

For one, there were "record" job cuts of 63,000 people from businesses last month. Yow. That hurt. (Frankly, I wish the media wouldn't even call it a "record job cut"--just say 63,000 people lost their jobs and don't put a headline on it. Not that it's the media's fault, don't misunderstand).

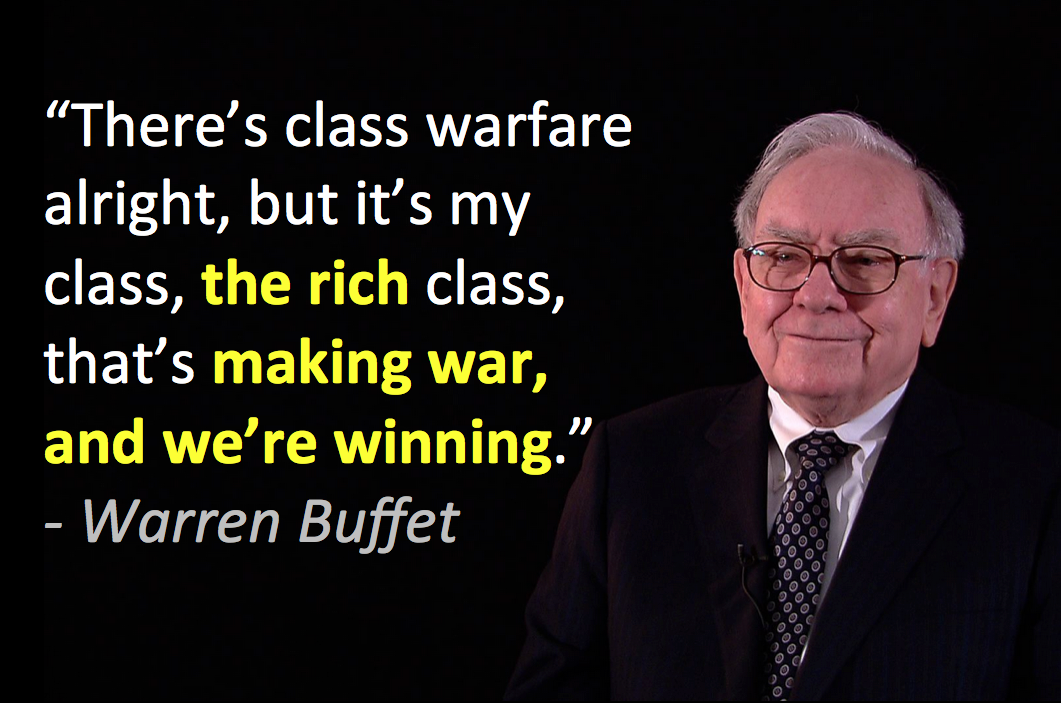

And two, Warren Buffett is now the top billionaire in the world, according to Forbe's Magazine.

No, I really am using that as levity. That is NOT the second-most important business article of the day. The information behind that headline is, though. Check this out:

In 2006, half of the top 20 billionaires in the world on Forbes Magazine's list were Americans.

Got that? Half. Fifty-percent.

Last year? One year later?

4

(Yes, that's f-o-u-r).

Another yow.

My reason is pointing this out is, yes, obvious on the face of it. Sure, fewer Americans are in the top 20 billionaires.

So what, right?

This isn't a "pity party", as my brother would say. And certainly not a sympathy gathering for the uber-wealthy.

My point is, the money is flowing OUT of the country and INTO others. Google "Dubai" if you haven't already. That's one of the biggest. Do a search for Exxon-Mobil's profits for the last 2 years. That's another. Check out China's growth for the last several years. You know where to look.

It ain't pretty, folks.

If it's hurting the uber-wealthy, it's gonna' really hurt those of us down here, eh?

And we've just started.

This is the top of the roller-coaster, I think, where you take that first, big, comforting deep breath. And then...

(I'd be happy to be--and hope I am--wrong).

![Warren Buffett courtesy of @[168132096542955:274:Patriotic Millionaires for Fiscal Strength]](https://fbcdn-sphotos-d-a.akamaihd.net/hphotos-ak-snc6/s480x480/165455_621077204587191_339243124_n.jpg)